Francesca Lennox

Francesca Lennox is a renowned technology author who dedicates her extensive experience in the tech industry to delivering profound insights into emerging and digital innovations. She earned a Bachelor of Science degree in Computer Science from the prestigious California Institute of Technology and a Master of Science in Information Systems from Stanford University. Francesca spent several years as a senior software engineer at DynaTech, a top-tier technology company situated in Silicon Valley, which further solidified her expertise in the digital sphere. Her work - showcasing a deep understanding of complex tech processes and future trends - has been widely published and recognized by numerous reputable tech journals and publications. Francesca's combination of practical experience and academic prowess make her an authoritative voice in the tech community.

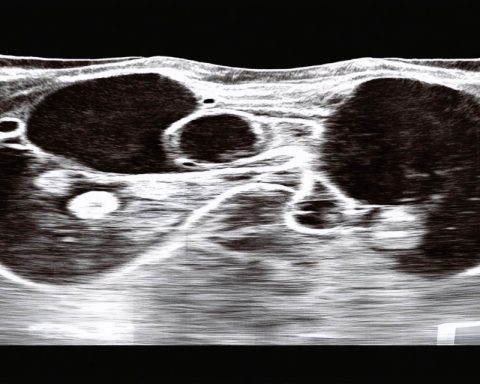

Revolutionary Ultrasound Treatment Offers New Hope for Liver Cancer Patients

Revolutionizing Liver Cancer Treatment: UVA Health Pioneers Non-Invasive Ultrasound Therapy

The Meteoric Rise of Micron Technology: Why AI’s Memory Boom Signals a Bright Future

Turbulent Markets: Navigating Tariffs and Tech Troubles

Revolutionizing Prostate Cancer Treatment: The Dawn of Precision Medicine

From Legacy to Learning: The Inspiring Tale of Two Cars Transforming a Kansas University

John Fogerty: From CCR to Chatbots – The New Spin on Setlists

The Infusion Center Revolution: Transforming Cancer Treatment Care

How Genetics and Precision Medicine Are Transforming the Fight Against Cancer

Can Wolfspeed Navigate the Silicon-Carbide Storm?